Sparsh Defence Pension Portal (A Complete Guide) – Login, Register & More

The Sparsh Defence Pension Portal was launched by Principle Controller of Defence Accounts (Ministry of Defence) for effective management and disbursement of pensions for defence pensioners of the Army, Navy, Defence Civilians, and Air force.

The Sparsh Defence Pension Portal provides pensioners with the ability to view their eligible pension amount, disburse pension to bank account, grievance management, and other disbursement related services. The Sparsh Portal is developed by India’s largest I.T company Tata Consultancy Services.

We will talk about some of the most important aspects of Sparsh Defence Pension Portal, such as:

- What is Sparsh Defence Pension Portal?

- How does Sparsh Defence Pension Work?

- How to Login to Sparsh Defence Pension Portal

- How to Register with Sparsh Defence Pension Portal

- Features and Benefits of Sparsh Defence Pension Portal

- Sparsh Defence Pension Customer Support

What is Sparsh Defence Pension Portal?

What is the full-form of Sparsh Defence Pension Portal? SPARSH stands for The System for Pensions Administration – RakSHa (SPARSH). SPARSH was introduced in October-2020, and the roll-out continued till August 2021.

In fact, in 2021-22, the Sparsh Defence Pension Portal had onboarded over 5 lakh defence pensioners, and disbursed over 11600 crores in pensions that year alone.

The core activities of Sparsh Defence Pension Portal are the following:

- Pension intimation and sanction.

- Pension disbursement directly in the pensioner’s linked bank account.

- Complete history of all pensions received.

- Complete profile of the pensioner.

- System to make complaints and get complaints solved.

- Generate pension slips.

- Identification through life certificate.

How does Sparsh Defence Pension Work?

Let us now understand how Sparsh Defence Pension Portal works:

- The portal is made by TCS, and pensioners need to register/login to the portal to begin using it.

- The pensioner will be allotted a unique account number.

- The pensioner can use this unique account number to initiate their pension claim requests.

- Once a claim is initiated by the pensioner, the claim gets sent to the Pay Accounts Office, where the claim is verified and approved. This process is called the Pensioner Data Verification (PDV).

- Once approved, the pensioner can see their approved claim on the Sparsh Defence Penstion Portal.

- Now, they can initiate a payout request to their linked bank account through the portal.

How to Login to Sparsh Defence Pension Portal

Let us now understand how you can login to the portal by following these simple steps.

Step 1.) Visit the Official Sparsh Defence Portal

First, you will need to visit the official portal. You can either search for ‘Sparsh Defence Portal’ on your preferred search engine and navigate to the official portal, or you can visit the official Sparsh portal here.

Step 2.) Enter your Credentials

Now, click on the ‘Login’ button on the top right hand side. You will now be redirected to the login page. Kindly use your username and password, enter the captcha, and press on ‘Login.’

Note that your username and password will be sent to your registered mobile phone or email ID if you are eligible to receive a pension. Use this to login to the portal.

Step 3.) Submit Declarations

Now, a pensioner may be required to submit some declarations on the portal. These declarations are case specific. Go through these requirements and submit the declarations if required.

Step 4.) Submit Aadhar and complete PDV

Next, you will need to submit your Aadhar number to the portal. Once you submit your Aadhar number, you will be initiate the Pensioner Data Verification (PDV) process. Once the PDV process is complete by the Pay Accounts Office, you will get an imitation stating that the PDV process is complete.

Also, Be sure your change your account password and make your Sparsh account secure.

Step 5.) Use the Portal

Finally, you can now access all of the features and benefits of the portal. Make yourself familiar with the portal interface and spend some time there to get the hang of it.

How to Register with Sparsh Defence Pension Portal

Let us now talk about how a pensioner can register himself on the Sparsh Portal.

Step 1.) Visit the Sparsh User Registration Page

First, a pensioner will have to visit the new user registration page on the portal. You can also access it from here.

Step 2.) Enter your Details

Now, you will be prompted to fill-up a whole host of details. Kindly fill-up these details and click on ‘Register.’

Features and Benefits of Sparsh Defence Pension Portal

Mentioned within are some of the most important features and benefits of the Sparsh Portal:

- View and Update Pensioner Profile: The portal gives the option to view and update all details pertaining to a defence pensioner.

- Update Dependent Details: You can also update your family or dependent details on the portal to ensure clarity and continuity.

- Pensioner Data Verification (PDV): Sparsh can check and validate all details pertaining to a pensioner and ensure that all records are up to date and valid.

- Application Tracking: A pensioner can track his or her application and can get real-time status updates for the same.

- Grievances: A pensioner can also lodge a grievance and get a resolution on the same through the Sparsh portal.

- Identification through Life Certificate: A pensioner can upload his or her life certificate and authenticate themselves on Sparsh. Once authenticated, they can initiate a pension request.

Login ID not Received to Pensioner

- Pensioners who have not received their login ID need to register their grievance on the Sparsh Portal. You can access the grievance / complaint lodging page here.

- Now, you will need to enter a list of details including PPO number, mobile number, email ID, Account number, full name, and more. Once entered, kindly lodge your complaint.

You can also lodge a complaint by navigating to the ‘services section’ on the Sparsh homepage, and navigate to the ‘Grievances’ part.

Once your complaint is registered, Sparsh will send across your user ID and password to your registered mobile number. Post this, you can login to your Sparsh account.

How to Download and Read PPO

Find out how a pensioner can read his or her PPO after downloading it.

How to Read PPO

A PPO will have the following important details mentioned within it:

- PPO Number

- Full Name

- Regimental Number

- Date of Enrollment and Discharge

- Record Office

- Last Held Rank

- Payment Details (including pay level, military service pay, classification allowance, average pay for last 10 months, pay in pay matrix, and last emolument drawn)

- Beneficiary bank account details

- Lump sum entitments

- Recurring payments

- Spouse Details (including Aadhar number, PAN, Name, Phone Number, and Email ID)

- Family Details (including children details)

How to Download PPO

Let us now find out how you can download your PPO in simple steps:

- First, login to your Sparsh account.

- Next, click on ‘My Documents’ on the left-hand side.

- Now, navigate to the ‘Pensioner PPO’ section.

- Download and open your Pensioner PPO PDF file.

Sparsh Defence Pension Customer Support

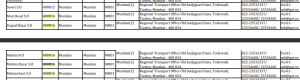

Sr. No | Address | Contact Details |

1.) | Principal Controller of Defence Accounts (Pensions), Draupadi Ghat, Near, Sadar Bazar, Prayagraj, Uttar Pradesh – 211014 | 18001805325 |

2.) | SPARSH Seva Kendras |

Author Bio

This article is written by Team InsuranceLiya.com, an independent website that writes about insurance, finance, health, and more. Our writers have a wealth of knowledge, experience, and degrees in the fields of insurance, finance, economics, and beyond.

Experience the power of Artificial Intelligence (A.I)

Chat with our super-intelligent A.I model and ask it anything about insurance and related products.