Learn about Life Insurance Corporation of India (LIC)

Life Insurance Corporation of India (LIC) is the largest life insurer in the country. LIC has a long-standing history of providing its policyholders with competitive and beneficial life and term insurance products.

LIC is a statutory corporation that was brought into existence with an act of parliament through the LIC Act 1956. As it suggests, LIC came into existence on 1st September 1956.

LIC has a tremendous amount of business around the nation, with revenues exceeding US$75 Billion (in 2019), and net income exceeding US$380Billion (in 2019).

The company is also one of the largest employers in the world with over 1.14 Lakh employees.

This content piece will aim to talk about the most important topics relating to the LIC of India from the perspective of a potential policy buyer. So, if you are considering purchasing a LIC policy, you will find this article worth reading.

Topics covered are:

- History about LIC

- LIC shareholding

- LIC facts and features

- LIC policies

- Benefits of LIC

- Objectives of LIC

- How to check LIC policy status

- LIC customer support

History about LIC

Let us understand the history of LIC along with some of the most important milestones:

Founding of Oriental Life Insurance Company: The British empire founded the Oriental Life Insurance company in Kolkata in 1818. This insurance company only catered to the British. It had the objective of providing life insurance and related services to only British individuals, not Indians.

Founding of Bombay Mutual Life Assurance Society: This was the first Indian life insurance company, started in 1870. The company was incorporated in Madras. This was the first life insurance company in India that provided life insurance services to Indians without any discrimination.

Founding of Bombay Life Assurance Company: This was another Indian Life insurance company that provided life insurance products to Indians. It was founded in1908, headquartered in Bombay.

The emergence of other Swadeshi insurance companies: The following other Swadeshi insurance companies were incorporated as part of the Swadesh Movement-

- National Insurance Company

- United India Insurance Company

- National Indian

- Bharat Insurance Company

And more.

First insurance regulator in India: The Indian Life Insurance Companies Act was passed in the British Parliament to regulate the insurance sector in India. Its task was to regulate the premium costs, competition, and ensure fair practices within the insurance sector in India.

Indian Insurance Companies Act of 1928: This act was enacted by the government in 1928. It gave the government the power to collect insurance company data. This act leads to more accountability among Indian insurance companies.

Insurance Act 198: The Insurance Act 1938 was brought into power by combining previous insurance acts and merging them into a single act. This act is still applied to date and does regulation work of the Indian insurance industry.

LIC Act 1956: It was decided by the Parliament of India that regulating over 245 large insurance companies was becoming challenging. Thus, it was decided that all these companies would be merged into a single entity, this entity would be called Life Insurance Corporation of India (LIC). LIC of India started its operations shortly after.

LIC shareholding

- 100% shares owned by the Government of India

- 95% profits distributed across policyholders and 5% retained by the Government of India

- It was proposed in the 2021 budget that LIC could go for an Initial Public Offering (IPO), where a minority stake will be sold to the public via an IPO.

LIC facts and figures

Particulars | Data |

Date of incorporation | 1956 |

Headquarters | Mumbai |

Total policy holders | 29 Crores |

Total assets under control | US$440 Billion |

Total revenue (2019) | US$79 Billion |

Net income (2019) | US$380 Million |

LIC policies

Let us now talk about the list of policies offered by LIC. All LIC policies are classified under different sections, they are:

- Insurance policies

- ULIP policies

- Pension plans

- Health plans

- Micro Insurance policies

LIC insurance policies

Endowment plans

| Policy name | About the policy |

|---|

| LIC Bima Jyoti | This policy is a non-linked, non-participating life assurance savings policy. This policy provides a lump sum amount to the policy nominee in the event of the policyholders demise. |

| LIC Bachat Plus | This policy provides death as well as savings component to the policyholder. |

| LIC New Jeevan Anand | This policy provides the holder with death benefit, maturity benefit along with continued lifetime cover. |

| LIC Saral Jeevan Bima | This is a non-linked pure risk insurance policy. |

| LIC New Bima Bachat | This is a single premium money back policy that provides life coverage along with a savings component. |

| LIC Jeevan Labh | This is an endowment policy that provides retirement benefits to the policyholder. |

| LIC Aadhar Shila | This is a special policy for the benefit of women. This policy provides life coverage, maturity and loyalty addition benefits. |

| LIC Aadhar Stambh | This is a life insurance policy that provides liquidity to the policyholder during challenging times through its auto-cover loan feature. |

| LIC Jeevan Umang (Whole life plan) | This is a whole life policy that provides life coverage to the policyholder up till 99 years of age. |

Money back plans

| Plan name | About the plan |

|---|

| LIC Jeevan Tarun | This is a specially structured plan to meet the educational demands of today’s students. It provides a regular payment option to the policyholder every year. |

| LIC Bima Shree | This is a plan that provides death benefit, maturity benefit, survival benefits and guaranteed add-ons. Minimum entry price is Rs 10 Lakhs. |

| LIC New Money Back Plan (20 years) | This plan provides death benefit along with periodic payments to the policyholder. |

| LIC New Money Back Plan (25 years) | This plan provides death benefit along with periodic payments to the holder. |

| LIC New Children’s Money Back Plan | This plan can be purchased by parents of children between the ages of 12 years or lower. It is a plan that provides life coverage of the child along with regular payments at intervals to the holder. |

| LIC Jeevan Shiromani Plan | This is a life coverage plan with additional benefits. This plan is targeted towards high net worth individuals as its entry price is Rs 1 Crores. |

Term plans

| Plan name | About the plan |

|---|

| LIC Jeevan Amar | This is a term insurance plan with options for 2 types of death benefits (regular sum assured or increasing sum assured). |

| LIC Tech Term | This is an online-only plan that provides term coverage to the insured. |

Add-ons/Riders

| Name | About the plan |

|---|

| LIC Accident Benefit Rider | This is a rider that provides accident coverage to the insured. This can be bought along with another comprehensive plan that covers critical illnesses. |

| LIC New Critical Illness Benefit Rider | This add-on provides protection to the policyholder if the policyholder is suffering from a pre-existing sickness. |

| LIC Linked Accidental Death Benefit Rider | This is a linked accidental death rider. |

| LIC Accidental Death and Disability Rider | This rider provides protection in the event of accidental death or even disability. One should avail of this rider along with another comprehensive plan for maximum protection. |

| LIC Premium Waiver Rider | This rider provides relief in future premium payment in the event of the policy proposer’s demise. |

| LIC New Term Assurance Rider | This is a basic term assurance rider that provides life coverage for a specified term. |

ULIP policies

| Policy name | About the policy |

|---|

| LIC SIIP | This is a unit-linked policy that provides death and maturity benefits. |

| LIC Nivesh Plus | This is a single premium unit-linked policy that provides death and maturity benefits. |

| LIC New Endowment Plus | This is a unit-linked retirement plan. |

Pension plans

| Plan name | About the plan |

|---|

| LIC New Jeevan Shanti | This is single premium annuity plan that provides deferred annuity to the policyholders. |

| LIC Jeevan Akshay 7 | This is an annuity plan that has varied options. The policyholder can either start his annuity immediately or after a specified time frame. |

| Pradhan Mandri Vaya Vandana Yojana | This is an assured pension plan that provides pension facility to elders at a rate of interest of 7.4%. |

Health plans

| Plan name | About the plan |

|---|

| LIC Health Protection Plus | This is a ULIP plan that provides health coverage along with savings and investment component. |

| LIC Jeevan Arogya | This is a health plan that provides comprehensive health coverage like surgical coverage, hospital cash, ambulance costs, NCB etc. |

| LIC Cancer Cover | This plan providers coverage for cancer and related illnesses. |

Micro insurance policies

| Policy name | About the policy |

|---|

| LIC New Jeevan Mangal | This is a micro insurance savings plan that provides a guaranteed payment of 110% of total amount of premiums paid on policy maturity. |

| LIC Micro Bachat | This is a micro insurance policy that provides death and maturity coverage. |

| LIC Bhagya Lakshmi | This is a non-linked micro insurance plan with a savings component. |

Benefits of LIC

- Sovereign guarantee: Any amount invested with LIC has the full guarantee of the Indian Government. This means that the policyholders will get their money back in the event of the company’s winding up.

- High claim settlement ratio: LIC has a high claim settlement ratio of 96.69% (in 2019-20). This means that the company has settled roughly 97 out of every 100 claims. This is a very healthy claim settlement ratio.

- Focus on welfare of policyholders: LIC always has its focus on the welfare of its policyholders above everything else. It is a government entity, has the objective of people’s welfare.

- A vast variety of policies: LIC offers a vast variety of policies that a policyholder can avail. There are all types of policies like endowment policies, retirement policies, money-back policies, health plans, child plans, general term and life insurance plans, and more. There is something for everyone at LIC.

- 24×7 support: LIC offers its customers the benefit of 24×7 customer support, so customers can address their grievances and queries at any time.

Objectives of LIC

Let us learn about the most important objectives of LIC below:

- Increasing the penetration of insurance and related products within India.

- Ensure the welfare of the common population.

- Keep the policyholder’s interests always on top.

- Conduct insurance-related business as efficiently as possible.

- Encourage an environment of savings among the people.

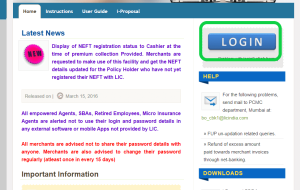

How to check your LIC policy status

LIC has made it quite easy for existing policyholders to check the status of their respective policies. They can check their policy status easily and seamlessly through the LIC website. Let us understand the process in simple steps.

Step 1: Register yourself with the LIC e-services account

Enter your policy number, date of birth, name, mobile number, etc within the fields and click on the ‘Proceed’ button.

Step 2: Login to your LIC e-services account

Enter your login credentials and press on ‘Sign in’. You will now be redirected to the dashboard.

Step 3: Enter your dashboard

Once entered, navigate to the ‘Policies’ section to the left and click on your policy. You can now view your policy details within the portal.

LIC customer support

LIC Call Center | SMS Helpzone | Email |

022 6827 6827 (24×7) | SMS LICHELP to 9222492224 | corporate.enquiry@licindia.com (corporate inquiries) |

18004259876 (for health plans) | SMS LICHELP to 56767877 | List of LIC email ID’s |