West Bengal Health Scheme (WBHS) – A Complete Guide

The West Bengal Health Scheme (WBHS) is health scheme for State Government Employees in West Bengal. This scheme was introduced by The State Government of West Bengal in 2008, in association with the state’s finance department. WBHS provides cashless health coverage to eligible state government employees of West Bengal.

This is one of the most important social healthcare schemes in the state, and has proved to be beneficial to lacs of state government employees in West Bengal.

Let us now discuss about some of the most important aspects of this scheme and provide you with a complete and detailed overview of the scheme. Topics discussed below are:

- Features and benefits of WBHS

- Coverage under this scheme

- How to register under WBHS?

- How to apply for a claim under WBHS?

- WBHS Eligibility criteria

- WBHS Portal

- How to login to WBHS

- WBHS Hospital list

- WBHS Rate Chart

- WBHS Downloads

- WBHS Online Claims

- WBHS Contact Details

Features and benefits of WBHS

Mentioned below are some of the most important and notable benefits and features of The West Bengal Health Scheme (WBHS):

- Cashless indoor treatment coverage up to Rs.1.5 Lakhs per beneficiary. If the treatment cost goes beyond Rs.1.5 Lakhs, reimbursement is subject to clauses mentioned within the scheme.

- Option for OPD treatments and consultations are also available.

- Surgical treatment is covered.

- A total of 1014 different medical conditions are covered under WBHS.

- Cashless treatment is provided, but the beneficiary will need to visit a network hospital in order to avail cashless coverage. Further, if a scheme beneficiary gets treatment in a non-network hospital, he/she will only be eligible to receive reimbursement up to a certain percentage of the treatment cost.

Notable statistics of this scheme

- Some notable stats include (As of 2022):

- 888985 beneficiaries of these scheme

- 175 Private Hospitals Empaneled under this scheme

- There are over 500+ treatments at any given time

Coverage under this scheme

A wide variety of diseases and disorders are covered under this scheme. Let us list some of the most common diseases covered under the scheme:

- Neurology

- Cardiology

- Laparoscopic/Endoscopic operations

- E.N.T

- Ophthalmology

- General Surgery

- Nephrology

- Vascular Surgery

- Dental treatment

- Burns

- Respiratory disorders

- Skin disorders

- Obstetric disorders

- Gynecology

- Malaria

- Tuberculosis

- Crohn’s Disease

- Rheumatoid Arthritis

- Hepatitis

- COPD (Chronic obstructive pulmonary disease)

- Diabetes

- Renal failure

- Thalassemia

- Animal bites

- Accidents

- LUPUS

You can get a complete list of all diseases covered here.

How to register under WBHS?

You can register under The WBHS Scheme in the following simple steps:

Step 1) Visit the official WBHS Website

Step 2) Hover over the ‘Online Enrolment’ tab and click on ‘Govt Employee’

Step 3) Enter your date of employment

Step 4) Enter your personal details and family details and proceed

Step 5) Upload the requested documents to the website

Step 6) Save all the details and take a print of the application form

Your registration is now complete.

How to apply for a claim under WBHS?

You can file a claim under WBHS using the below mentioned simple steps:

Step 1) First, you will need to show your WBHS Card to your hospital

Step 2) The hospital will verify your WBHS Card

Step 3) Upon completion of treatment, the government will disburse the treatment cost to the hospital

WBHS Eligibility Criteria

The below mentioned people are eligible for enrolling under WBHS:

- Employees of The State Government of West Bengal, their families, pensioners and their families

- All India Service Officers and pensioners

- IPS, IAS, and IFS Officers

- Beneficiaries who have opted for this scheme as medical allowance

WBHS Portal

This scheme scheme is tech-savy and a lot the scheme features and benefits can be handled through the online WBHS Portal. Further, all scheme related documents, forms, information, and additional features can be accessed through the portal. You can access the portal here.

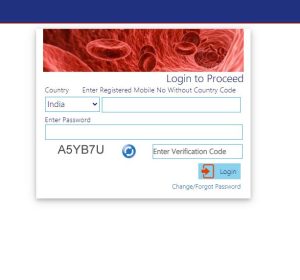

How to login to WBHS

You will need to login to the WBHS Portal in order to access scheme related features like submitting a claim, uploading your documents, monitoring your claim status and more. Let us now find out how you can login to your account.

Step 1) Visit the official WBHS Portal

Step 2) Click on the green ‘Login’ button on the top right hand side

Step 3) Enter your User ID, Password, Captcha and press on OK

You will now be logged into your WBHS Account

WBHS Hospital list

All Government Hospitals, clinics, diagnostic centers that come under the management of The State Government of West Bengal are empaneled under this scheme.

There are also certain selected private hospitals that are empaneled under this scheme. You can find a list of all of the empaneled hospitals here.

Some notable hospitals empaneled with WBHS include:

Sr. No | Notable Hospitals Empanelled under WBHS |

1 | Ruby General Hospital |

2 | Desun Hospital and Heart Institute |

3 | Charnock Hospitals |

4 | ECO Hospital and Diagnostics |

5 | Nightingale Diagnostic and Medicare |

6 | Vivekananda Hospital |

7 | Sanjiban Hospital |

8 | Glocal Hospital |

9 | Dreamland Nursing Home |

10 | K.P.C Medical College and Hospital |

11 | Paramount Hospital |

12 | The Calcutta Medical Research Institute |

13 | Malda Nursing Home |

14 | Mission of Mercy Hospital |

15 | Citylife Hospital |

WBHS rate chart

All procedures covered have a maximum rate chart that they need to adhere to. You can access the entire rate chart of all procedures and surgeries, and their associated maximum coverage rate here.

WBHS Downloads

You can download all necessary forms from here.

Downloadable forms include the following:

- Application form

- Claim submission form

- E-payment mandate form

- Rate chart

- Claim reimbursement form

WBHS Online Claims

You can initiate an online claim through the WBHS Online Claim page. But first, you will need to login to your WBHS Account.

WBHS Contact Details

Department | Contact Details |

Technical Helpline | support.hshed-wb@nic.in, 18001028014 |

Government Offices | wbhsgovt.officeassist@gmail.com |

All Hospitals | wbhshospitalassist@gmail.com |

Officials | Contact Details |

Mr. Aloke Kumar Mukherjee (WBA & AS Joint Secretary) | 033-2254-4197, js1med.fd-wb@gov.in |

Mr. Swayambhu Dey (Accounts Officer and Ex-Officio Assistant Secretary) | 033-2254-4730, 033-2254-4730 |

Mr. Manikratan Dey (OSD & EO Joint Secretary) | 033-2254-5049, dsmed.fd-wb@gov.in |

Related articles

Experience the power of Artificial Intelligence (A.I)

Chat with our super-intelligent A.I model and ask it anything about insurance and related products.

Frequently asked questions

The full form of WBHS is West Bengal Health Scheme.

2008

Mamata Banerjee

Yes, it is solely available to state government employees in Bengal.

https://wbhealthscheme.gov.in/